The gold price falls to a new weekly low in the context of the USD’s general bullishness.

Lower expectations for a Fed rate cut in March raise US bond yields and support the dollar.

The negative impact on the safe-haven metal is limited by geopolitical risks and China’s economic difficulties.

On Wednesday, the price of gold (XAU/USD) fell to a new weekly low, but it was able to withstand and rise above the 50-day Simple Moving Average (SMA) support during the early European session. Nonetheless, the precious metal remains red for a second day in a row as there are fewer bets on an early Federal Reserve (Fed) interest rate cut. The US dollar (USD) is rising to its highest level since December 13 as a result, supporting higher US Treasury bond yields and potentially hurting the non-yielding yellow metal.

Nevertheless, global unrest and China’s relatively weak economic growth statistics serve to contain further losses and provide some support for the safe-haven gold market. Therefore, it would be wise to hold off on making any new bearish wagers on the XAU/USD pair until there has been a consistent collapse through the previously indicated support. The US economic docket, which includes the publication of monthly retail sales and industrial production data, is now the focus of market players’ attention. In addition, Fedspeaks will affect the USD and provide the precious metal with additional momentum.

Everyday Compilation Market Shifters: Gold prices drop as a result of Fed rate cut uncertainty, and losses are limited by a lower risk tone.

The comments made by Governor Christopher Waller of the Federal Reserve (Fed) on Tuesday further dampened prospects for a rate decrease in March and acted as a drag on the price of gold, which is not yielding.

Waller continued, causing the yields on US Treasury bonds to spike substantially higher, saying that the Fed must exercise caution and cannot move quickly to decrease rates while the economy is still doing well.

The benchmark 10-year US government bond yield remains stable above the 4.0% mark, supporting the US dollar and restricting the amount of non-yielding yellow metal.

The possibility of more Middle East tensions rising does nothing to calm the safe-haven XAU/USD or encourage optimistic traders.

The US recently conducted another airstrike against a Houthi missile complex in Yemen, citing a threat to US Navy ships and commerce boats.

According to official figures from the National Bureau of Statistics (NBS), China’s economy expanded in the last quarter of 2023 at an annual pace of 5.2%.

Quarterly GDP growth in China was 1.0% in Q3 as opposed to the 1.0% anticipated, and December saw increases in industrial production and retail sales of 6.8% and 7.4% YoY, respectively.

The NBS stated that low consumer prices are a reflection of insufficient domestic demand and that China’s economy is facing a complicated external environment following the release of the high-impact data.

In addition to China’s economic problems, geopolitical concerns could discourage traders from making strong bearish wagers on the metal and potentially prevent further losses.

Traders now turn their attention to the US macro data, which is predicted to reveal that industrial production was unchanged in December and monthly retail sales increased by 0.4%.

In addition, planned remarks by Fed Governors Michelle Bowman and Michael Barr could affect the USD and give the commodity some momentum.

Also Read – What is Forex?

Technical Evaluation: While not quite out of the woods, the gold price finds some support near the 50-day SMA.

Technically speaking, the 50-day SMA, which is presently at $2,017, along with the monthly low at $2,013, could stop the immediate decline before it reaches the psychological $2,000 barrier. A strong break below the latter will be interpreted by bearish traders as a new set of signals, pushing the price of gold towards the December swing low, which is located in the $1,973 range. The 100- and 200-day SMAs are located in the $1,969–1,963 confluence, which might eventually see a decline in the XAU/USD pair.

Conversely, the $2,040-2,045 area appears to be a significant barrier that is in place ahead of the $2,061-2,062 supply zone. If the $2,077 region is convincingly cleared, some follow-through purchasing might push the price of gold higher and eliminate any short-term negative bias. Then, bullish traders could try to take back the psychological $2,100 level.

The US dollar exchange rate for this week

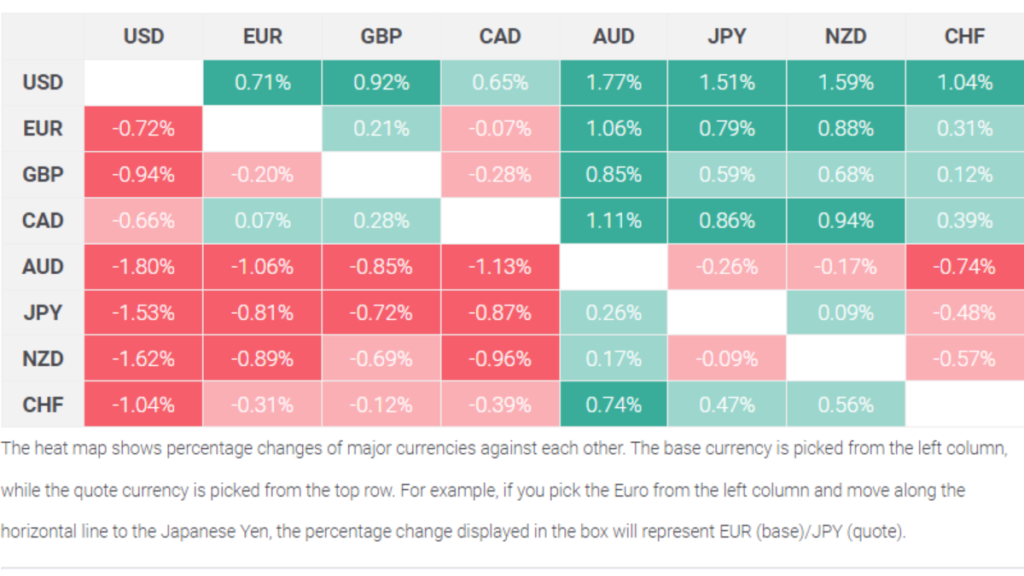

The US dollar’s (USD) percentage movement compared to a list of major currencies for this week is displayed in the table below. In relation to the Canadian dollar, the US dollar was the weakest.

Why do individuals purchase gold?

Because gold has been used so extensively as a means of exchange and store of value, it has played a significant role in human history. Nowadays, the precious metal is regarded as a safe-haven asset, which means that it is a wise investment during uncertain times, in addition to its shine and use in jewelry. Since gold is not dependent on any one issuer or government, it is also frequently viewed as a hedge against inflation and declining currencies.

Who purchases the most gold?

Central banks possess the largest amount of gold. Central banks typically diversify their reserves and purchase gold to boost the perceived strength of the economy and the currency in an effort to support their currencies during unstable periods. A nation’s solvency may be viewed with confidence if it has substantial gold reserves. Based on data from the World Gold Council, central banks added 1,136 metric tons of gold, or approximately $70 billion, to their holdings in 2022. This year’s purchase is the largest since records have been kept. The gold reserves of central banks in emerging economies, such as China, India, and Turkey, are rising rapidly.

In what way does gold connect to other assets?

The US dollar and US Treasury bonds, which are important reserve and safe-haven assets, have an inverse relationship with gold. Gold often rises when the dollar weakens, allowing central banks and investors to diversify their holdings during tumultuous times. Gold and risky assets have an adverse relationship as well. The price of gold usually declines during a stock market gain, but it tends to rise after sell-offs in risky markets.

What factors affect the price of gold?

Numerous variables can cause the price to fluctuate. Because gold is a safe haven, geopolitical unrest or worries about a severe recession can cause its price to rise swiftly. Lower interest rates tend to increase the value of gold since it is a yield-less asset, but rising financing costs often have a negative impact on the yellow metal. Since the asset is valued in US dollars, the majority of movements still rely on how the USD performs (XAU/USD). While a weaker dollar is likely to drive up gold prices, a strong dollar tends to keep the price of gold under check.

Note: The author and Trending Khazana are not registered investment advisors and nothing in this article is intended to be investment advice.