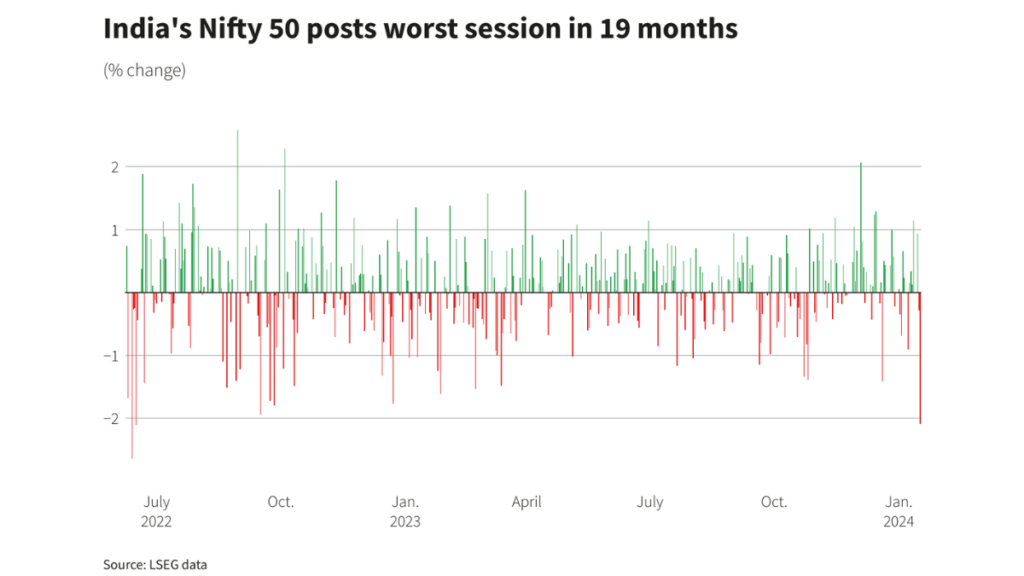

On Wednesday, the blue-chip indices in India experienced their worst session in 19 months, primarily due to a decline in the leading private lender HDFC Bank following its quarterly reports.

The S&P BSE Sensex (.BSESN) opened a new tab and lost 2.23% to 71,500.76, while the blue-chip NSE Nifty 50 (.NSEI) opened a new tab and shed 2.09% to 21,571.95. Since June 2022, neither index has experienced a greater percentage decline in a single day.

Concerns about HDFC Bank’s sluggish margins caused the most heavily weighted company on the indices, HDBK.NS, to fall 8.44% in its largest one-day decline since May 2020.

The latest spike in the indexes was preceded by better-than-feared reports from leading IT companies, which raised expectations for stronger earnings growth.

“With profit booking occurring at 22,100 levels, the Nifty shows no signs of ease. We anticipate some weakening in domestic equities over the next two weeks following the recent IT-driven rise, according to IIFL Securities director Sanjiv Bhasin.

The entire financial services index (.NIFTYFIN) and the bank index (.NSEBANK), which HDFC Bank pulled, both opened new tabs that were slightly less than 4% down.

Markets are anticipating either pressure on margins or a halt in loan growth, which might cause some de-rating in the industry, according to Axis Securities PMS chief investment officer Naveen Kulkarni.

Of the 13 key sectors, twelve saw losses.

Also Read – What is a stock market?

China, the world’s biggest producer and user of metals, failed forecasts for economic growth in the December quarter, which caused metals (.NIFTYMET) to drop 3.13%.

A 3.56% increase in L&T Technology Services (LTEH.NS) helped IT stocks (.NIFTYIT) open a new tab and gain 0.64%. The software services firm maintained its revenue growth target for fiscal year 2024.

Analysts anticipate increased money flowing into IT stocks following their above-market results.

Note: The author and Trending Khazana are not registered investment advisors and nothing in this article is intended to be investment advice.