- On Monday, the Japanese yen gained buyers and partially offset the significant losses of the previous week.

- The likelihood that the BoJ will abandon its ultra-lose stance in January is decreasing, which will limit future gains.

- High US bond yields are still supporting the USD and helping to stabilize the USD/JPY.

On the first day of a new week, the Japanese Yen (JPY) draws some haven flows and pulls the USD/JPY pair away from a three-week high that was set on Friday, roughly in the 146.00 neighborhood. Diminished prospects for a more aggressive policy easing by the Federal Reserve (Fed) impact investor sentiment and help the traditional safe-haven Japanese yen (JPY) against the backdrop of China’s economic troubles and geopolitical risks.

Any further gains for the Japanese yen JPY are restrained, nevertheless, by the growing consensus that the Bank of Japan (BoJ) would not abandon its negative interest rate policy during its meeting on January 22–23 following the Japanese earthquake on New Year’s Day. Conversely, the US dollar (USD) finds it difficult to build on its recent, modest rebound from a multi-month low as a result of speculation that the Fed may begin lowering interest rates as early as March.

Nevertheless, the latest US economic data indicated that the economy is still robust, giving the Fed greater leeway to maintain higher interest rates for an extended period of time. This keeps the yields on US Treasury bonds high, as do the recent hawkish comments made by Fed members. This is therefore expected to provide support to the USD/JPY pair and operate as a tailwind for the greenback, so before making any directional bets, exercise caution.

Daily Digest Market Movers: The Japanese Yen gains from the recovery of demand for safe havens but is not overly optimistic.

The Japanese Yen had a sharp decrease last week, down more than 2%, marking its worst weekly performance since June 2022 as expectations of an impending change in the Bank of Japan’s policies later this month faded.

Strong US job data for December adds to the uncertainty surrounding the Federal Reserve’s projected rate-cutting path, supporting the US dollar and sending the USD/JPY pair to a three-week high on Friday.

The US economy added 216K new jobs last week, compared to 170K predicted, according to the headline in the NFP print. The unemployment rate remained stable at 3.7%, while it was projected to rise to 3.8%.

The Institute for Supply Management (ISM) report, which showed that the US services sector—which makes up more than two-thirds of the economy—plummeted last month, countered the positive figures.

The employment sub-component fell to 43.3 in December, the lowest since July 2020, from 50.7 in November, and the ISM’s Non-Manufacturing Index fell to 50.6 in December, the lowest level since May.

Separately, US factory orders rose 2.6% in November compared to a 3.4% decline in October, which was better than anticipated but did not significantly boost the USD bulls.

According to the report, there were areas of weakness in the world’s largest economy, but overall it remained strong, which led investors to reduce their expectations of the Federal Reserve’s easing policy more aggressively.

Furthermore, Dallas Fed President Lorie Logan stated that there is a chance that inflation may increase again and reverse progress if the US central bank does not maintain adequately tight financial conditions.

This comes after Richmond Fed President Thomas Barkin stated last week that rate hikes are still on the table and that he is certain the economy is headed for a soft landing.

Nonetheless, the markets continue to factor in a higher likelihood of the Fed cutting interest rates for the first time at its policy meeting in March, as well as five rate cuts totaling 25 basis points (bps) in 2024.

As the focus now turns to the US consumer inflation statistics on Thursday, this is keeping the USD bulls in check and preventing them from setting up for any further appreciating move.

House Speaker Mike Johnson and Senate Majority Leader Chuck Schumer have broken the impasse to prevent a government shutdown by agreeing on a topline spending level.

Technical Analysis: Below the mid-144.00s, USD/JPY is still defensive, and further decline appears unlikely.

Technically speaking, Friday’s failure close to the 50% Fibonacci retracement level of the decline from November to December should cause optimistic traders to exercise caution. Furthermore, oscillators on the daily chart have not yet confirmed a positive bias, although they have recovered from the bearish area. Therefore, it would be wise to hold off on positioning for an extension of the USD/JPY pair’s recent recovery from the 140.25 zone, or a multi-month trough struck in December, until there is some follow-through purchasing above the multi-week high, roughly the 146.00 mark. A further increase in current prices might push them over the 146.55 intermediate barrier and back up to 147.00, where the 61.8% Fibo level and the 100-day Simple Moving Average (SMA) are located: 147.40–147.45.

Conversely, the 200-day SMA, which is now positioned close to the 143.25 zone, and Friday’s swing low, which is located around the 143.80 region, are expected to be shielded from further declines by the 144.00 mark. Should there be a strong breakdown below the latter, the short-term bias may return in favor of bearish traders, leaving the USD/JPY pair exposed to testing the next significant support in the 142.35–142.30 horizontal zone before a final decline to the round number of 142.00. The downtrend may continue toward the 141.75 support on the way to the 141.00 level and the multi-month low, which is located in the 140.25 range

Current value of the Japanese Yen Today

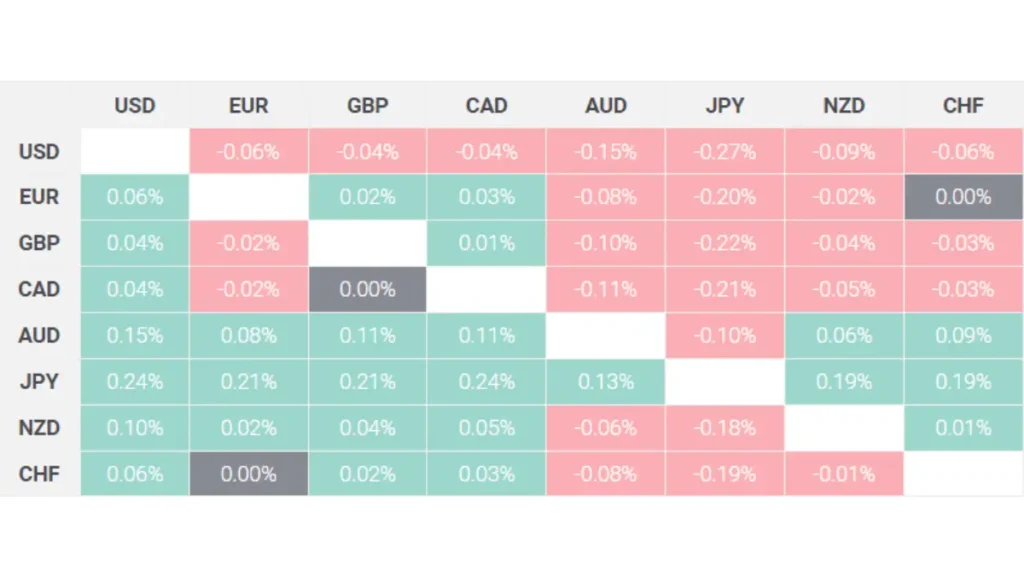

The Japanese Yen’s (JPY) percentage movement against the main currencies listed today is displayed in the table below. The strongest currency versus the US dollar was the Japanese yen.

Also Read – India government plans to ban nine international cryptocurrency platforms

Notice: Trending Khazana does not endorse the opinions or suggestions expressed above; rather, they represent the opinions of certain analysts or broking firms. Before making any financial decisions, we suggest investors to consult with qualified specialists.